30-second summary:

73% of online shoppers are expected to chase post-holiday bargains while 76% of eBay buyers plan to take advantage of after-Christmas and New Year shopping deals.

33% of brands that shifted their ad dollars in Q1 and Q2 of 2020 moved money to ecommerce.

SMS conversion rate increased 98% over Q2 making it a priority to add SMS to email strategies.

Three must-have omnichannel touchpoints to induce conversions.

CTV ad impressions grew by 2X, 55% YoY, the only medium to see such accelerated growth.

23% of consumers are more comfortable sharing data about their likes/dislikes, gender, and location data.

56% of businesses without CDPs have limited ability to apply insights holistically across their marketing efforts.

D2C retail companies have a customer-first approach that is 2X better than their non-transactional counterparts.

This week we share revenue-driving insights on omnichannel marketing and CTV advertising that can help ecommerce businesses increase consumer trust across marketing channels throughout the holidays and beyond.

State of ecommerce and the holiday season

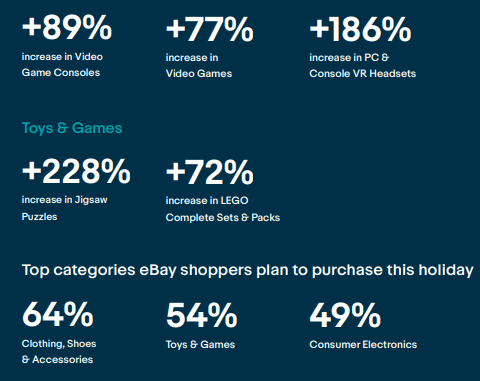

eBay Ads surveyed 2000 eBay shoppers and 2000 online shoppers to uncover the state of ecommerce during the gifting season.

31% of online shoppers started holiday shopping before September 30 this year (13% YoY growth)

73% expecting to chase post-holiday bargains while 76% of eBay buyers plan to take advantage of after-Christmas and New Year shopping deals

Ecommerce ad spend is projected to grow +14.9% in Q4

COVID-19 has increased the importance of ecommerce as a media platform by 40%

33% of brands that shifted their ad dollars in Q1 and Q2 of 2020 moved money to ecommerce

Holiday shopping started earlier than usual and will also stay longer than usual.

Did you know?

An eBay shopper looking to buy a cell phone or smartphone takes 21 days on average to make a purchase.

Here’s a look at some of the holiday season gift categories and how they fare.

Omnichannel marketing and conversions

Ecommerce Email Marketing and SMS Platform, Omnisend, published its quarterly report, Email, SMS, and Push Marketing Stats & Trends Rep (Q3 2020) that analyzed nine million SMS and push messages sent by 50,000 global merchants. Even though automated consisted of just 2% of email sends they drove nearly 32% of the email marketing conversions in Q3 2020.

Some other key takeaways on omnichannel marketing (Email, SMS, and push notifications):

Promotional email campaigns’ conversion rate was 7.66% for Q3, a 168.9% YoY spike

Post-purchase emails whose open rates surged to 38.23%, an increase of 13.65% compared to Q2.

SMS conversion rate increased 98% over Q2 making it a priority to add SMS to email strategies

Stages that need to be prioritized

Ecommerce brands can induce more conversions only if they prioritize communicating at these touch base with their online buyers’ journey milestones. Automated emails need to be prioritized for these stages:

Welcome (these campaigns converted at 52%)

Cart abandonment (these campaigns converted at 42%)

Browse abandonment (these campaigns converted at 25%)

Co-Founder and CEO of Omnisend, Rytis Lauris, emphasized the key role of omnichannel communication,

“The use of SMS and push messages by marketers will increase this holiday season as a growing number of consumers see them as trusted ways to engage with brands,” added Lauris. “Ecommerce businesses must embrace SMS now or risk falling behind.”

CTV: A platform you can’t ignore for video ads

Independent advertising and analytics platform built for television, Innovid, revealed some surprising insights in their fall 2020 edition of its U.S. Video Benchmarks Report.

Their findings represent a bird’s eye view of video advertising data:

CTV ad impressions grew by 2X, 55% YoY

Compared to mobile & desktop, CTV is the only device that gained more impression share, jumping from 33% in 2019 to 41% in 2020

Interactive ads had 14x the engagement rate of the next highest ad type

Video ad completion rates served on desktop PCs beat mobile across all formats

DTC and direct response advertisers grew +300% YoY in Q2 2020

China and the US lead in CTV adoption

23% of consumers are more comfortable sharing data about their likes/dislikes, gender, and location data

How video ads performed

Contrary to typical trends of video ad spends hitting breaks, CTV viewing grew by leaps and bounds in 2020 winning more attention from advertisers. Despite CTV’s unparalleled growth, mobile devices defended a narrow lead of 2% over CTV, while desktop impressions continue to trend downward.

When analyzing growth by comparing standard and advanced video impressions, mobile growth fared better with advanced (formats that are personalized or interactive) video (+27% YoY), while CTV dominated standard (+56% YoY).

Interactive ads delivered great viewing experiences and had 14x the engagement rate of the next highest ad type.

Customer data: The center of the advertising universe

CDP provider BlueVenn collaborated with London Research found that companies that collated and analyzed customer data grew by 16% in the last year. In fact, they were twice as more likely to exceed business goals and see great ROI.

The Omnichannel Marketing Excellence report is based on a global survey of 235 organizations with annual revenues of at least $50m across the US (42%) and the UK (38%).

Other key findings from their report:

Businesses with clean customer data are 2X more effective with cross-channel synchronized communication that is tailored for consumer needs (40% vs. 24% for non-CDP users)

56% of businesses without CDPs have limited ability to apply insights holistically across their marketing efforts

D2C retail companies have a customer-first approach that is 2X better than their non-transactional counterparts

Of the 30% of companies that integrated their paid, owned, and earned digital channels in a strategic fashion, only 21% of those synchronized and coordinated both digital and offline activity across a variety of inbound channel

ClickZ readers’ choice for the week

This week, our readers have been looking at the other side of martech, offline customer engagement, and the real metrics for success identification.

The dark side of marketing technology (martech)

Why retention marketers are focusing on offline customer engagement

Fool’s gold – Leaving behind “match rate” as a success metric for identity

The post Key Insights: Ecommerce, omnichannel marketing, CTV, and holiday season conversions appeared first on ClickZ.

Source: ClickZ

Link: Key Insights: Ecommerce, omnichannel marketing, CTV, and holiday season conversions