30-second summary:

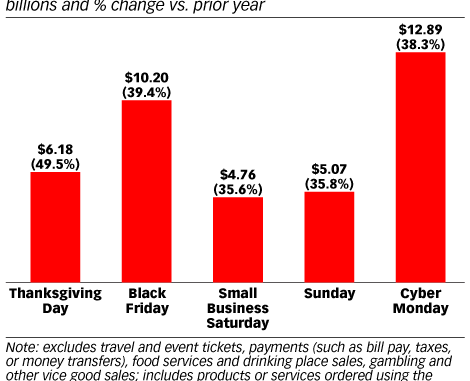

Cyber Monday and Black Friday are set to smash the $10 billion ballpark figure in ecommerce sales.

Thanksgiving is expecting a 49.5% sales growth.

US retail ecommerce sales to reach $190.47 billion, which is a 35.8% jump.

Consumer behavior insights that will help retailers take advantage of the shorter calendar window between Thanksgiving, Hanukkah, and Christmas will positively impact holiday shopping dynamics.

Our latest Marketing Automation Summit data shows that 13% of businesses do not use marketing automation while 47% use some of it, and 28% are exploring their options.

We tracked $52 million of investment in Marketing Technologies during October.

Who got the funding? What are the top martech? How can you pivot strategy to ace holiday sales? Let’s help you find answers.

After the smashing success of Amazon Prime Day, Cyber Monday and Black Friday are set to smash the $10 billion ballpark figure in ecommerce sales. 2020 has been unpredictable to the extent that despite the pandemic, high unemployment rates, and looming recession have not phased holiday season shopping. Deloitte forecasts a 25% to 35%, YoY growth in ecommerce sales for the 2020-2021 holiday season. The expected cap ranges between $182 billion-$196 billion which is a 14.7% growth vs 2019. Our market intelligence report, too, has some insights to uncover, read on.

In fact, Thanksgiving is expecting a 49.5% sales growth.

What’s even better? There’s a shorter calendar space between Thanksgiving, Hanukkah, and Christmas that will positively impact holiday shopping dynamics. Here are some of eMarketer’s latest holiday shopping sales forecasts:

US retail sales to rise to $1.013 trillion (a 0.9% increase)

US brick-and-mortar retail to decline to $822.79 billion (a 4.7% decline)

US retail ecommerce sales to reach $190.47 billion (a 35.8% jump)

Ecommerce retail sales set to account for 18.8% of total retail sales

Feeding the consumer appetite the right way

Our earlier key insights have extensively covered holiday season shopping trends, digital strategy, and consumer preferences, and CXO. Here’s a complete look at the consumer behaviors for November-December 2020 and how you can feed it.

Top five countries that were leading in consumers adopting new shopping behaviors:

India – 96%

China – 86%

US – 73%

Italy – 69%

UK – 63%

Of these 40% of consumers tried new brands while just 12% of consumers showed brand loyalty saying they would shop from the same brand they shopped from in 2019.

Omnichannel and social media marketing will be the flavors of the season, read more on this here.

Blockbuster dates for holiday season shopping

According to McKinsey & Company, 39% of people will be spending more on special shopping while 44% intend to spend the same:

Black Friday – Nov 27

Cyber Monday – Nov 30

Thanksgiving

Hanukkah

Pre-Christmas sales

Get more insights on milestone dates of holiday season shopping 2020 here.

Factors that make consumers pick a retailer to purchase from

ClickZ Market Intelligence Report – October Highlights

Our ClickZ and SEW Pulse Survey has tracked senior marketers’ views through April to October to constantly track the industry shifts. Here are some highlights from our October Market Intelligence Report:

Marketing technology spends remain consistent at 32% of marketing budgets being allocated to it.

Our latest Marketing Automation Summit data shows that 13% of businesses do not use marketing automation while 47% use some of it, and 28% are exploring their options.

‘Content & Experience’ and ‘Data’ are the top martech categories that marketers are keen on investing in

We tracked $52 million of investment in Marketing Technologies during October.

Want more insights that can help you make informed business decisions?

Get your copy of our October Market Intelligence Report that is packed with our exclusive industry insights and our Marketing Automation Summit data.

Top Martech – Market intelligence

‘Content & Experience’ and ‘Data’ are the two front runner technology categories. Detailed segmentation of these categories shows the following snapshot.

ClickZ readers’ choice for the week

This week, our readers have gravitated towards fixing their holiday season marketing strategies, customer eccentricity, and personalization.

7 quick marketing fixes you can apply before the holiday season

Maturing your digital strategy through customer centricity

Rethink experience curation not personalization

The post Key Insights: Exclusive market intelligence and ecommerce highlights appeared first on ClickZ.

Source: ClickZ

Link: Key Insights: Exclusive market intelligence and ecommerce highlights