This morning, Merkle released its quarterly Direct Marketing Report, ahead of Google’s own Q2 earnings announcement and it makes for a bumper stat-filled reading.

Of particular note are the revelations that:

Google search spending growth has slowed to 22% as CPCs fall 9%

Desktop PLA growth rate jumps while mobile growth is strong but slowing

Shopping Ads traffic from Google image search and Yahoo surges

Google’s expanded text ads have had only a modest impact

The full report (registration needed) covers the latest trends in paid search, organic search, social media, display advertising, and comparison shopping engines, so let’s cherry-pick some of the highlights…

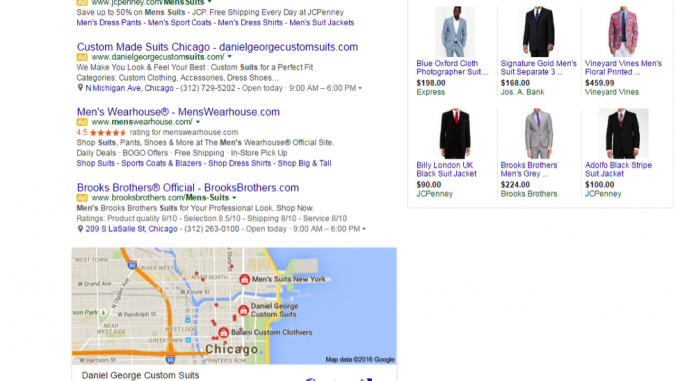

Paid Search

Advertiser spending on Google paid search grew 22% Y/Y in Q2 2016, a slight deceleration from 25% growth in Q1.

Click growth increased slightly to 34%, but CPCs fell 9%.

Spending growth for Google text ads slowed to 10% Y/Y as CPC growth for brand keywords fell from 10% in Q1 to 0% in Q2.

Google Shopping Ad spending growth rose to 43% as an influx of partner traffic bolstered total click volume.

Combined spending on Bing Ads and Yahoo Gemini search ads fell 17% Y/Y as click declines continued to worsen.

Bing Product Ad spending fell for the first time since the format’s launch, likely the result of Yahoo moving to show more Google PLAs.

Phones and tablets produced 53% of all paid search clicks in Q2, the same rate as a quarter earlier, but up 12 points from a year earlier. Google’s share of clicks from mobile increased slightly to just over 57%

Organic Search & Social

Organic search visits fell 7% Y/Y in Q2, down from 11% Y/Y growth a year earlier, as organic listings face increased competition from paid search ads, particularly on mobile.

Mobile’s share of organic search visits rose to 46%, but that still lags behind the 53% of paid search clicks that mobile produces, as well as the 47% share that mobile produced for organic search a year ago.

Google produced 86% of all organic search visits in the US and 90% of mobile organic search visits.

Google’s share of mobile organic search has increased by nearly two points in the past year.

Social media sites accounted for 2.8% of site visits in Q2 2016, with Facebook producing 63% of all site visits driven by social media.

Comparison Shopping Engines

The eBay Commerce Network commanded a majority of advertisers’ comparison shopping engine (CSE) spending for the first time in Q2. Along with Connexity, the two dominant CSE platforms accounted for 97% of all CSE ad spending.

Advertiser revenue produced by eBay Commerce Network and Connexity listings grew by 33% and 23% Y/Y respectively; however, the two platforms combined for less than 10% of the revenue produced by Google Shopping Ads, among advertisers participating in all three platforms.

Display Advertising

Total display advertising spending grew 62% Y/Y, driven by very strong results from Facebook, where Merkle advertisers increased their investment by 121% Y/Y.

Retargeting accounted for 62% of all display spending in Q2.

The Google Display Network (GDN) also delivered spending growth, with advertisers seeing its share of total Google ad spending increase to 12%.

Source: ClickZ

Link: 17 useful search marketing stats from Merkle’s Q2 2016 report

Leave a Reply