Google’s hard push into machine learning and automated bidding – and away from more manually controllable optimizations – builds a sense of exasperation for experienced PPC marketers.

The January revision to the “remove redundant keywords” recommendations, where they announced the removal of redundant exact and phrase match keywords in favor of broad match, was an aggressive example of that trend.

And it’s made some of us wonder if it’s time to reconsider a long-time little sibling of the paid search world, Microsoft Advertising.

In late 2022, Microsoft announced its ambitious goals for capturing a greater share of brand advertising budgets.

With such a promising prospect, let’s look at Microsoft Ads (or Bing Ads, as most PPC marketers still fondly call it) in relation to Google – including advantages, disadvantages, and opportunities for the platform to make some gains in market share.

What advantages does Microsoft search offer over Google for PPC experts right now?

There are a couple of major advantages Microsoft (and its search engine, Microsoft Bing) offers over Google as I’m writing this.

The first is an EQ advantage: I’ve found their reps to be reliable, helpful, and far less likely to push an agenda than Google’s reps.

This might be expected of a challenger brand that needs to work extra hard for market share, but it’s still a plus to work with folks who look for ways to achieve your goals and do what’s right for your clients.

Strictly from a growth marketing perspective, Microsoft has the unique ability to pull in LinkedIn targeting, which could enable an account-based marketing (ABM) strategy for marketers looking for ways to leverage tighter budgets.

Microsoft offers targeting by job function, industry, and specific companies. They don’t have full LinkedIn targeting capability yet (more on that in a bit), but you can leverage job-function exclusions and company targeting to construct ABM targeting for brands in your ICP.

Microsoft’s Search Partners network also includes DuckDuckGo, which gets some buzz even though – or maybe because – it’s a privacy-first platform and not an ad network.

If you’re interested in testing DuckDuckGo, you can exclude other placements in Search Partners to try and concentrate spend there, but you can’t actually isolate it for a clean test.

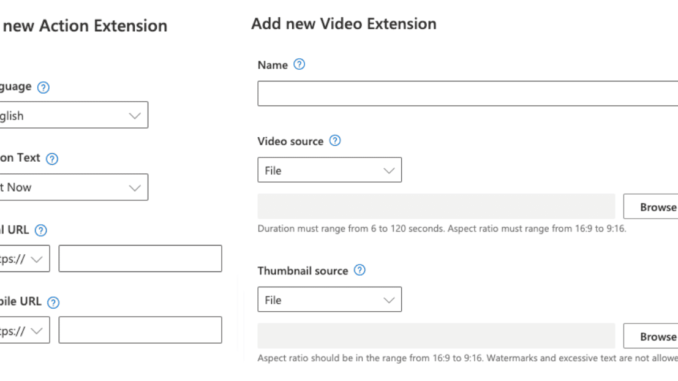

On the features front, Microsoft recently beat Google to the punch by rolling out video extensions, which complement action extensions and review extensions as nicely built-out ad features.

Get the daily newsletter search marketers rely on.

<input type=”hidden” name=”utmMedium” value=”“>

<input type=”hidden” name=”utmCampaign” value=”“>

<input type=”hidden” name=”utmSource” value=”“>

<input type=”hidden” name=”utmContent” value=”“>

<input type=”hidden” name=”pageLink” value=”“>

<input type=”hidden” name=”ipAddress” value=”“>

Processing…Please wait.

SUBSCRIBE

See terms.

function getCookie(cname) {

let name = cname + “=”;

let decodedCookie = decodeURIComponent(document.cookie);

let ca = decodedCookie.split(‘;’);

for(let i = 0; i <ca.length; i++) {

let c = ca[i];

while (c.charAt(0) == ‘ ‘) {

c = c.substring(1);

}

if (c.indexOf(name) == 0) {

return c.substring(name.length, c.length);

}

}

return “”;

}

document.getElementById(‘munchkinCookieInline’).value = getCookie(‘_mkto_trk’);

What disadvantages persist for Microsoft Advertising?

The first and most obvious is scale. Although Bing has closed the gap with Google in search engine volume over the past three years, Google’s volume is nearly 10x that of Bing’s.

And Bing is a little sibling in other ways. It tends to mimic Google with a few months of lead time. (For instance, the deadline for switching to Bing RSAs is approaching, and they’re pushing Performance Max-like functions for ecommerce brands).

In other words, most functionality released by Google eventually comes out on Bing whether advertisers like it or not.

On the quality front, Bing has traditionally struggled to match the consistency of Google’s algorithm, which has been an issue for advertisers fighting to maintain control of their top keywords.

Recently, their exact match query results look nearly as good as Google’s and they share almost all search term data on all keyword types (~99%, compared to Google’s <80%).

If this is still a disadvantage, it’s minimal – and could actually become an advantage if Bing continues to focus on consistency.

When (and why) should advertisers consider investing and testing more on Microsoft Advertising?

In my clients’ accounts, lower levels of competition for keywords on Bing generally result in lower CPCs than Google’s.

While this doesn’t always result in higher conversion rates (in fact, those tend to be higher on Google), it can result in more efficient CPLs.

That said, the scale is much lower that the competitive CPLs alone don’t justify big resource shifts.

But Bing is a smart play in a couple of scenarios.

We always recommend keeping an eye on your brand terms to protect your turf. This might seem obvious, but there are lots of brands that forget that step.

Lower CPCs can help you get enough volume to understand what your spend is delivering.

I still recommend fully funding Google, but if you’re seeing a relatively soft month or opportunities to save budget from scrubbing lower-performing keywords on Google, it might be worth testing Bing.

Overall, if you’re putting in a consistent investment into Google and struggling to improve or maintain returns, look at where return has dropped and consider scaling that back and re-investing into Bing tests.

Where should Microsoft focus on improving to compete with Google?

Microsoft appears to be going all in on AI, given its recent $10B investment in OpenAI and its red-hot ChatGPT functionality.

If it incorporates ChatGPT into Bing search, as is rumored, it could instantly make waves for Bing as a trendy, user-friendly alternative to Google, helping it wrest away some market share.

On the advertising budget front, one thing I’d strongly recommend Microsoft work on providing advertisers is the ability to create audiences from LinkedIn targeting.

In-market audiences for B2B represent a major soft spot for Google that Microsoft should exploit as soon as possible. This could be a great grassroots ABM option for companies that can’t pay for expensive ABM tools.

There’s also room to add plenty of nuance to the existing LinkedIn-like targeting. The ability to target by job title and, more importantly, the ability to drill down by using the “and” piece of and/or targeting, would give B2B advertisers a nice level of precision that Google doesn’t have.

Along with targeting and chatbot innovation, I’d recommend Bing focus on buttoning up its offline conversion tracking.

It’s come a long way with the combination of the Microsoft click ID and the auto-tag for use with CRMs, but it’s not as robust as Google’s offline tracking, which is a big deal for B2B optimization.

Don’t overlook Microsoft Ads

At this point, other than in a few specific use cases, I don’t have a compelling argument for shuttling resources away from Google and over to Bing. That said, Microsoft is steadily building momentum with room to create more.

If Google’s engagement costs continue to climb, and Microsoft focuses on releases that allow advertisers to reach the right people more efficiently, the picture could change.

For now, keep an eye on product releases and announcements. Stay ahead of the curve on adoptions from a platform determined to become more relevant in the coming months.

The post Microsoft Ads in 2023: Key areas to leverage, test and optimize appeared first on Search Engine Land.

Source: Search Engine Land

Link: Microsoft Ads in 2023: Key areas to leverage, test and optimize