30-second summary:

Despite the pandemic, CTV advertising remained a stable ad channel with a growing audience across the US and Europe.

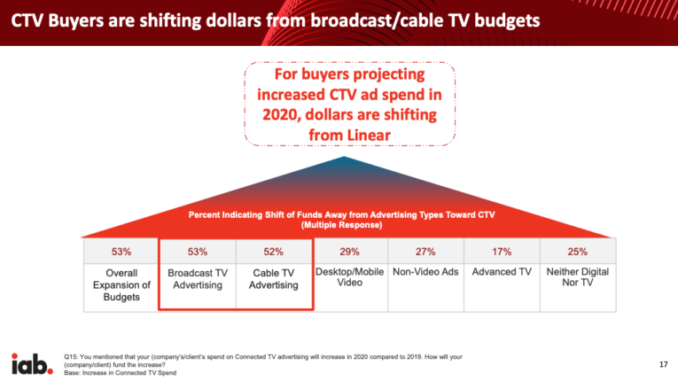

More than 50% of US ad buyers shifted their ad spend from linear TV to CTV.

The increasing popularity of CTV among viewers and advertisers is accompanied by streaming-platform wars, where Roku is leading, so far.

With advertising opportunities, though, Roku brings their channel owners some challenges and limitations.

Over the next few years, one might see more AR/VR content and ads across CTV

CTV measurement is becoming more mature

By the end of the last year, viewership on CTV had skyrocketed, and the lockdown only strengthened the trend. Thus, as of March 2020, 80% of households in the USA alone had at least one connected TV device.

The CTV trend is also booming across Europe. Especially the U.K., where 60% of viewers there use CTV as their primary source for watching TV.

The CTV owners’ army keeps steadily expanding thanks to cord-cutters and cord-nevers, gradually getting linear television off the radar. Hence, the number of cord-cutter and cord-never US households will amount to 48.9 million by the end of this year and reach 61.5 million in 2023.

The more viewers consume video content served on CTV, the more opportunities and interest this tendency creates for advertisers. So far, over half of US ad buyers have already started shifting dollars from Broadcast (53%) and Cable TV (52%) advertising towards CTV.

Besides, the average CTV spend for the year is increasing, expected to reach $16MM per advertiser.

The CTV market share among streaming platforms

Among other interesting CTV trends is the way category leaders have carved up the marketplace. So far, CTV devices leading the category with 44.2% of viewers belong to Roku, who’s placing its head and shoulders over Amazon, Google, and Apple.

Apart from devices, Roku is #1 streaming platform in the US, with more than 43 million active accounts streaming content for over 14 billion hours.

Although tech giants like Google, Apple, and Amazon are also nurturing their streaming platforms, their audiences lag behind Roku,specifically:

Amazon Fire TV serves video content for 40 million monthly active users

Android TV has recently reached 50 million installs globally

The number of Apple TV subscribers varies from 10 to 33 million, based on different sources

Besides, the Roku platform offers the widest variety of channels and streaming services than other mainstream set-top boxes.

Roku ecosystem: Advertising opportunities and challenges

Compared to its streaming competitors, Roku provides ample advertising opportunities for both brands and Roku app channel owners. As for the advertisers, just a couple of months ago, Roku acquired Dataxu to put its assets into a new DSP, OneView.

When it comes to promotion possibilities for channel owners, the service offers its own content engagement and self-serve promotion toolkit. And this is where opportunities border with hurdles.

On the one hand, Roku publishers can grow their audiences by leveraging targeted display and video ads and joining the partnership program.

However, there are some pitfalls , inexplicable at first sight. CPM rates here can vary from $18 to $38, where installs and clicks will remain a riddle.

This is what Allroll, a marketing platform for CTV channel owners, is striving to solve. Its core purpose is to help content producers rapidly and cost-efficiently increase their apps’ exposure.

Compared to Roku rates, Allroll offers lower CPM rates (up to $10.00), and over 60% more installs for the same budget, spent on a native platform.

Where CTV is going?

The emergence of platforms, allowing CTV channel owners to optimize their budgets spent on their app promotion, is a logical part of CTV reality and it most likely will intend to go beyond the Roku platform alone.

Meanwhile, other trends related to ad formats and advanced attribution within the CTV landscape are upon us.

Augmented (AR) and Virtual Reality (VR) and 360-degree video content will infiltrate digital video and CTV in particular.

For instance, Apple announced they will bring VR experience to the viewers’ homes, streaming sports events and concerts, and letting them feel a real presence.

Alongside this, as education moves online at scale and now includes more youngsters, online games, educational, and entertaining content will be in even greater demand.

AR and VR will also bring an immersive component to advertising formats, making it more engaging and personalized.

Ecommerce advertisers will probably be the ones who’ll take the most advantage of the immersive technologies, offering their potential consumers to ‘try on’ clothes, jewelry, furniture, and other items.

Along with technological advancements coming in CTV, its measurement component is also growing in maturity. CTV offers advertisers and publishers advanced metrics to help them move consumers down the brand funnel.

These metrics include outcome-based measurement, brand lift, incremental reach, and frequency, and will continue to sharpen within the next several years, as the industry finds a common denominator regarding standardization.

Takeaways

As CTV keeps evolving at the speed of light, it’s essential not only to keep up with trends and embrace available advertising opportunities but also to consider the most efficient ad channels helping you to minimize your ad expenses while reaching viewers.

By establishing productive long-term partnerships and working more on personalization and analytical aspects of CTV advertising, we hope to contribute to independent-channel promotion across streaming platforms, and Roku in particular.

The post CTV advertising remains on the rise with new opportunities for Roku channel owners appeared first on ClickZ.

Source: ClickZ

Link: CTV advertising remains on the rise with new opportunities for Roku channel owners