30-second summary:

A region-wise snapshot of business deals to help you better target your marketing minutes and resource

Industries that are front runners of the pack in Q2 2020

Chatbots see the largest jump Q1 vs Q2 and the scope of marketing technology

63% of businesses are either pivoting business operations or revamping their 2020 game plan with new products/packages while 30% of businesses stay put

More key insights that can help you create the ideal marketing elixir and strengthen your business prospectus

The marketing landscape is seeing a magnitude of shifts while there’s speculation about economic recovery patterns. This week, we present you with insights that can help you re-engineer the business approach and master the perfect pitch.

Global progressions: Hotspots for marketers to pitch as economies open

Here’s a snapshot of region-wise business deals to help you get a better idea of where to target your marketing minutes and resources:

APAC created 5% lesser deals in Q2 vs Q1

North America created 6% fewer deals in Q2

EMEA and LATAM created 12% lesser deals

The four front runners of Q2 2020: Industry view

These were the industries that have shown the most muscle with a 25% growth:

Consumer goods

Human resources

Manufacturing

Construction

Consumer goods businesses experienced an 8% more deal closure. Consumer goods and Construction are leading the pack with a 45-50% growth escalation.

Businesses worldwide are seeing positive deal statistics. On the marketing technology front, Hubspot also tracked that chat volumes have peaked at 45% in late-May. In fact, the chat volume has jumped from Q1 to Q2 by 31%.

Our next section looks into the technology and business strategic revamps.

The post-COVID shock game plan: Marketers’ cheat sheet

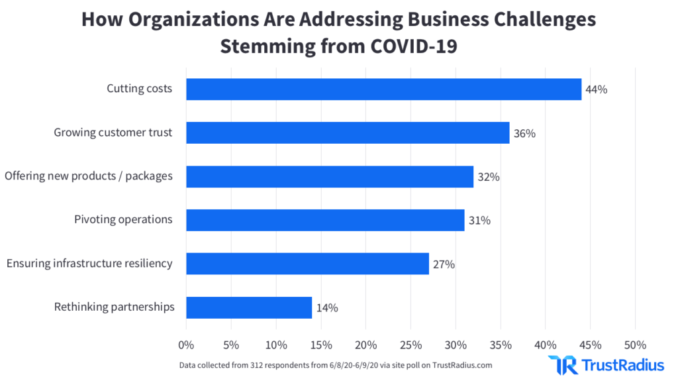

COVID-19 has inspired the world to do business differently and approach their strategies with innovation and thought. In their latest B2B research with tech industry analyst firm IDC, TrustRadius looked under the hood, and here are some key points that can help you create the ideal marketing elixir, the perfect pitch.

About 1 out of 3 experienced a large reduction while 28% have seen a moderate reduction in revenue

61% of businesses have seen a revenue reduction

63% said they were either pivoting business operations or offering new products/packages while 30% of businesses said they are not

1 out of 3 respondents said they were focusing on ‘growing customer trust’ during this time

Businesses want to build their online presence and strengthen their customer trust as a result of which companies are partnering with customer voice platforms

27% of respondents are focusing on “ensuring infrastructure resiliency” which means they would certainly depend more on technologies to streamline business operations

All the points mentioned above present a great opportunity for marketing technology service providers and businesses to capture more deals.

The TrustRadius report also found that 47% of businesses intend to involve digital events in their 2020 business offerings.

The elixir to winning more customers in retail and ecommerce

With stores closing down and being forced to move online, brands are vying more than ever to capture customer attention and score more sales, but how will they do it with slashed budgets and resources? Do they need a miracle? No. We’ll be highlighting some data-backed prerequisites from Avionos’ B2C buyer report that will serve as ingredients to marketers’ elixirs:

1. Fast shipping

76% of consumers said this created a positive shopping experience.

2. Simple and easy online/mobile shopping experience

70% of consumers said this was their favorite thing about digitally native brands while 52% of consumers said the same about shopping online with traditional retailers.

3. Sophisticated personalization

36% of customers expect personalized product recommendations on the website homepage. This figure has jumped by 28% vs 2019

4. Speed checkouts

60% of consumers said this created a positive shopping experience while shopping at brick and mortar stores.

Three more interesting key observations were:

75% of customers preferred in-store experience over traditional retailers’ in-store experience

Traditional retailers score exceptionally well at relationship-building and loyalty

Digitally native brands score better on convenience measures like fast checkout

The answer lies in asking the right questions

Since there’s no one panacea for business success, a balanced concoction of all these above factors can tailor the unfair advantage that marketers crave.

Questions marketers need to ask themselves are:

“How can we mirror and optimize the traditional in-store experience?”

“What are the data silos that are hampering the shopping experience personalization?”

“What strategy do we want to boost customer relations and maximize convenience?”

Getting concise answers to these by diving into your data will help your marketing game plan hit home.

ClickZ readers’ choice for the week

Our readers have been keen on uncovering insights, focusing on video marketing strategies, personalization, and Netflix, the mastermind.

Key Insights: Email marketing the titanium of martech, global dips can’t curb strategy, and more

Let’s build your B2B video marketing strategy based on these examples

Why brands need to take a strategic approach to personalization

Five changes in social advertising for brands during COVID-19

How Netflix uses big data to create content and enhance user experience

The post Key Insights: Global deal drills, marketers’ cheat sheet, and the customer winning elixir appeared first on ClickZ.

Source: ClickZ

Link: Key Insights: Global deal drills, marketers’ cheat sheet, and the customer winning elixir

Leave a Reply